The PCMA and its partners continuously strive to enhance financial inclusion in Palestine. In 2023, significant achievements were made in this context through a strategy with clear objectives and extensive participation from relevant stakeholders. The financial inclusion strategy aims to establish the foundations that ensure all segments of society have access to and use financial services and products that meet their needs. Achieving this requires a clear and well-defined action plan.

In this regard, following the completion of the reassessment phase in 2022 and as directed by the National Committee, the technical committee finalized the implementation plan for the remaining period of the 2023-2025 national financial inclusion strategy. This was done by evaluating the previous plan, reviewing the progress of its operations, and tasking specialized sub-groups, including the Consumer Empowerment Group, the Small and Medium Enterprises Working Group, and the Innovative Financial Services Group, to start holding necessary meetings and brainstorming sessions. These efforts aimed to complete the implementation plan based on the intervention policies approved by the National Committee and the outcomes of the 2022 reassessment project.

The Most Prominent Achievements of the PCMA in order to Enhance Financial Inclusion During the Year 2023:

- Calculating Financial Inclusion Indicators for the Non-banking Financial Sector

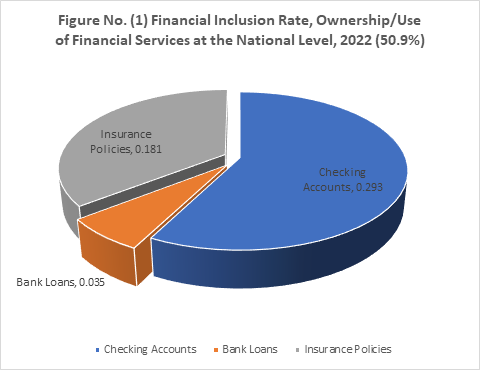

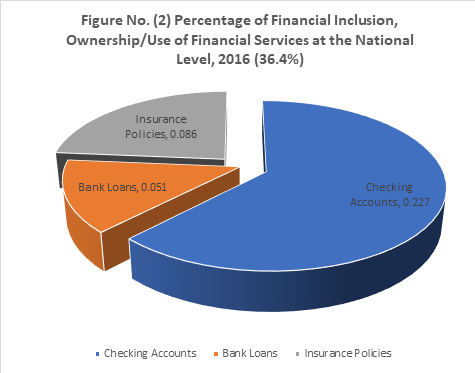

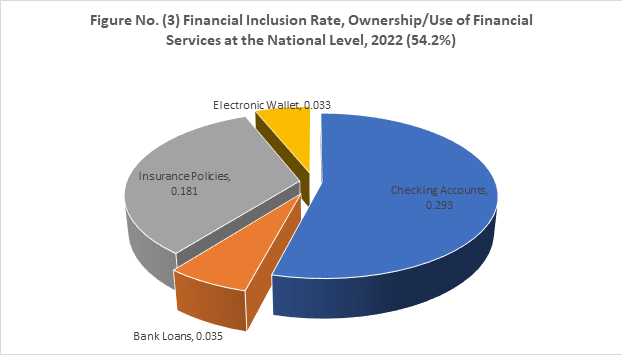

The PCMA continuously evaluates the progress of the outcomes of the implementation plan for the National Financial Inclusion Strategy 2018-2025. Annually, financial inclusion indicators specific to the non-banking financial sector are calculated, based on internationally recognized indicators while considering the Palestinian financial context. These indicators derive from three main dimensions of financial inclusion: access to financial services and products, the usage of these products and services, and quality. These indicators help measure the level of financial inclusion in Palestine and provide a clear picture of it, allowing comparisons between the current state of financial inclusion in Palestine with previous years and with other countries.

Financial Inclusion Indicators for the Non-banking Financial Sector for the Last Four Years

- Adoption and Announcement of the Results of the Reassessment of Financial Inclusion in Palestine

The National Committee for Financial Inclusion has adopted the results and outcomes of the Financial Inclusion Reassessment Project in Palestine, which was carried out in 2022. The results were announced at a national event that included the PCMA, the Palestine Monetary Authority, key strategy partners, representatives from the Alliance for Financial Inclusion (AFI) – the main funder of the reassessment project, representatives from the German Agency for International Cooperation (GIZ), along with banking, financial, and economic leaders, and representatives from various civil society organizations.

Following the comprehensive survey of both supply and demand sides, in addition to studying the ecosystem and the enabling environment for financial inclusion in Palestine, the outcomes highlighted significant progress in enhancing financial inclusion in Palestine. Despite the challenging conditions accompanying the implementation of the national strategy during the period (2018-2022), there has been progress in financial inclusion across its three dimensions: access, usage, and quality. The comprehensive survey results indicate notable improvements in access to and usage of the financial sector compared to the results of the evaluation conducted in 2016.

According to the below findings, significant progress has been made in the access and use of financial services during the period 2018-2022.

- Approving and Publishing the Executive Action Plan of the National Financial Inclusion Strategy for the Remainder of the Strategy’s Duration 2023-2025