- Granting No Objection Letters

In 2023, the PCMA continued its efforts to promote financial technology (fintech) for the non-banking financial sectors under its supervision. This was achieved through issuing “no-objection letters,” allowing innovators to operate in a live environment while retaining the PCMA’s full right to revoke the no-objection at any time if the conditions granted under it were violated.

Moreover, the PCMA provided individual guidance to each innovator of non-banking digital financial services regarding their innovation, while taking all precautions to ensure no harm to consumers during the trial examination period of the product or solution. Additionally, necessary measures were taken to combat money laundering and terrorist financing.

In this context, Middle East Initiative/ Tamweeli obtained a “no-objection letter” for the first time on December 1, 2021, to work on providing a service that connects citizens with insurance service providers and offers awareness about insurance services. Tamweeli’s platform allows individuals and companies, especially those marginalized or financially excluded, to access insurance services online without the need to visit insurance company branches to obtain insurance quotes.

Additionally, a no-objection letter was granted for the provision of vehicle pricing service through the website “Pal Blue Book.” This service enables the pricing of used vehicles in Palestine using artificial intelligence, taking into account the condition, age of the vehicle, and market supply and demand. Thus, it provides indicative prices that insurance companies and leasing companies can use within their operations if they wish. Furthermore, an extension of the no-objection letter was granted for the application “Verify ID” provided by Yafa Networks and Computer Systems Company “Yafa Net.”

- Regulatory Sandbox

The PCMA aims to harness financial technology in the sectors under its supervision. To achieve this, it is essential to test innovative financial technology applications in real-life situations with real customers. These are services that financial technology developers cannot currently provide in the Palestinian market, either due to regulatory obstacles or the absence of regulated regulatory frameworks. The regulatory sandbox environment enables startup companies in modern financial technologies to operate within a testing environment and offer their services to a limited number of consumers. This helps in the gradual maturity of these companies’ business models.

The regulatory sandbox environment aims to reduce the cost of innovation in some cases and provide space for regulatory intervention, thus providing a safe and formal framework for direct testing and market monitoring. It serves as an indicator of regulatory openness to innovations by testing innovations in a live market based on specific timeframes and scopes defined to reach the appropriate regulatory status before the innovation can operate fully in the market.

- Regulatory Innovation Platform “Ebtaker”

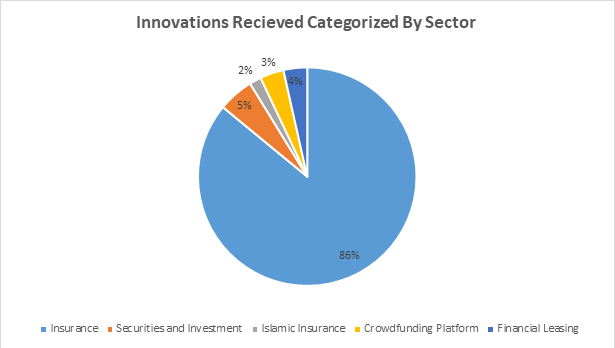

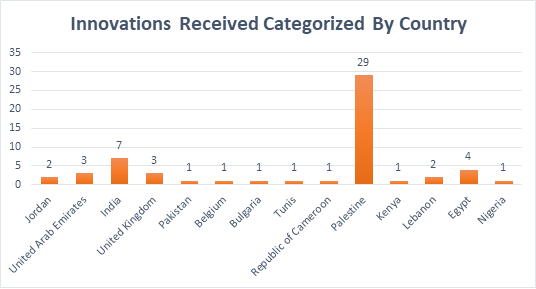

Since its launch in March 2021, the number of innovations received on the Ebtaker platform has reached 57 requests, related to financial technology ideas and solutions for the non-banking financial sector. The insurance sector accounted for the majority of ideas submitted to the platform, along with a variety of ideas related to securities, leasing, and crowdfunding sectors, aiming to obtain regulatory support and guidance. The Ebtaker platform provides support for innovations in line with the PCMA’s policy of encouraging innovation and current laws and regulations for understanding and compliance during development and refinement of ideas. It also offers guidance for obtaining licenses if there is a regulatory framework or entry into the regulatory sandbox environment and obtaining a no-objection letter. So far, four innovations have succeeded in obtaining a no-objection letter to operate under specific conditions. Additionally, three insurance companies that proposed ideas related to electronic applications have been referred for licensing under the prevailing instructions after receiving necessary guidance. The distribution of received innovations across sectors is illustrated in Figure (1) below, showing a concentration of innovations in the insurance sector, followed by innovations related to the securities and leasing sectors. Figure (2) illustrates the distribution of these innovations according to the country they were received from.

Figure 1: Innovations Received Through the Innovate platform Categorized by Sector

Attracting New Fintech-based Financial Solutions

In implementation of its strategic plan and to enhance its role in increasing the use of technology in the non-banking financial sectors, the PCMA launched the Regional Insurtech Competition, in cooperation with the German Agency for International Cooperation (GIZ) and sponsored by the Palestinian Insurance Federation.

The competition was launched through two tracks. The first track, “Insurtech Hackathon,” focused on handling innovations in the Ideation Phase, targeting individuals and solution providers from startup companies that are in the process of developing innovative ideas and concepts. Meanwhile, the second track, “Innovation Challenge,” focused on solutions and applications that are either in the implementation phase or ready for deployment.

The Innovation Challenge targeted established companies specialized in insurance technology and emerging technology companies with ready-to-implement solutions aimed at enhancing access to insurance products and services. This includes innovative distribution channels and insurance services targeting underserved categories such as small, medium, and micro-enterprises in marginalized yet promising sectors like agriculture.

Firstly, Insurtech Hackathon Track:

- BeNew Insurance: The idea presented from Cameroon focuses on providing micro life insurance products financed by converting the value of recyclable materials (plastic, paper, and iron) into insurance premium installments.

- Pay Day Takaful: The idea presented from the sister country, Tunisia, includes a microtakaful insurance product based on insurance technology, covering the feature of an employee or worker receiving a portion of their salary to address urgent financial obligations that may arise before the usual payday. It also includes coverage for income interruption due to injury, disability, or death.

Each winner received a financial prize of $5,000 USD provided by the Palestinian Insurance Federation.

Secondly, Innovation Challenge Track:

- Aura: Presented from the United Arab Emirates, it includes solutions for providing embedded insurance services, providing insurance companies with the necessary capabilities to easily execute underwriting operations, access reinsurance services, and offer insurance technology services to agents and brokers. All services are based on integrated operations provided through a comprehensive platform built on insurance technology.

- Kasko: Presented from the United Kingdom, it offers comprehensive (Insurtech as A Service) solutions aimed at assisting insurance companies in digitizing their operations to enhance operational efficiency, improve the consumer experience, develop innovative insurance products based on insurance technology, and create innovative distribution channels.

Each winner received a financial prize of $5,000 USD provided by the Palestinian Insurance Federation and GIZ, in addition to a qualitative prize consisting of hosting the winning solution by a local insurance company for testing the idea or application and exploring its potential for implementation within the Palestinian market. Both Al-Mashreq Insurance Company and Tamkeen Insurance hosted these winning solutions, in full coordination with the Palestinian Insurance Federation.